Employing staff in the Netherlands

As an employer, hiring a local salesperson or representative abroad, you might assume, quite understandably, that you can simply apply your own rules, because those are the ones you know. However, this is not without risk!

We have listed the most important topics for you on this page, including links to more extensive information :

How to set up a branch office in the Netherlands

We are happy to tell you more about the options, and to help you make the right choice for your situation. Our advice also includes the tax implications of the choice you make. We can also help you set up your administration to make optimal use of tax schemes in the Netherlands.

Click here to read the complete information on this subject >>

How to hire employees in the Netherlands? Global payroll, employer of record, umbrella services: what are the options?

When searching in internet for ‘payroll Netherlands’ or ‘hiring employees in the Netherlands’, Google will overwhelm you with companies offering global payroll or payrolling solutions, employer of record service, payroll service, umbrella services and so on. The list is endless. This can be very confusing. To make the best decision for your organisation and your Dutch employees, it is crucial to be aware of the consequences.

Click here to read the complete information on this subject >>

Find and keeping your employees in the Netherlands by including employee benefits in your salary package.

Adding employee benefits in your salary package is crucial. However, tax rules on benefits in kind & work expenses in the Netherlands are very strict, so you need to be careful about what you offer your employees.

Click here to read the complete information on this subject >>

Are you looking for a solution for financial accounting in the Netherlands?

In the Netherlands, bookkeeping should be in line with sound business practice. This includes consistent application and a certain freedom in how to determine the profit. This is different from other countries, such as Belgium, where the law strictly regulates the format of the accounting system.

Click here to read the complete information on this subject >>

How to avoid unnecessary risks in the Netherlands

We can explain which insurance policies you as a foreign employer are required to have, and we can advise you about supplementary insurance. This protects your company from any unnecessary risks and allows you to offer an excellent employee benefits package to your Dutch employees.

Click here to read the complete information on this subject >>

Advice on Dutch employment law

In theory, you can independently determine which country’s employment law you follow. However, mandatory provisions such as those concerning termination of employment, incapacity for work and working hours apply pursuant to employment law as imposed in the country where the employee works.

Click here to read the complete information on this subject >>

Payroll for employees in the Netherlands

Do you have remote employees or a local sales team in the Netherlands? Not happy with your current global payroll rpovider or employer of record? Please allow uw to introduce you to our full-service solution at Interfisc.

Click here to read the complete information on this subject >>

Pension for employees in the Netherlands

Employees in the Netherlands will only receive a minimum benefit when they retire, because the state pension in the Netherlands is not related to the wages someone earns. For this reason, about 90% of the employees in the Netherlands have a supplementary pension plan, arranged by the employer or via a social sector pension fund.

Click here to read the complete information on this subject >>

Occupational disability & Statutory Sick Pay in the Netherlands

As an employer in the Netherlands, you are responsible for continued payment of wages for two years if an employee is ill. You are also required to have a contract with a certified occuptional health service (arbodienst).

Click here to read the complete information on this subject >>

Many of us perceive taxes and tax advice as a necessary evil. But we also know that it is very important to follow the correct procudures. Both to make sure that we don’t pay too much tax and also to avoid any fines or unpleasnat and costly surprises later on.

Click here to read the complete information on this subject >>

Do you still have questions? Please contact us at your convencience by using our contact form or give us a call!

Checklist

Have you arranged everything properly for your employees in the Netherlands? Ask yourself 5 important questions:

Download

Download our latest Whitepaper ‘Pitfalls when hiring local staff or remote employees in the Netherlands‘

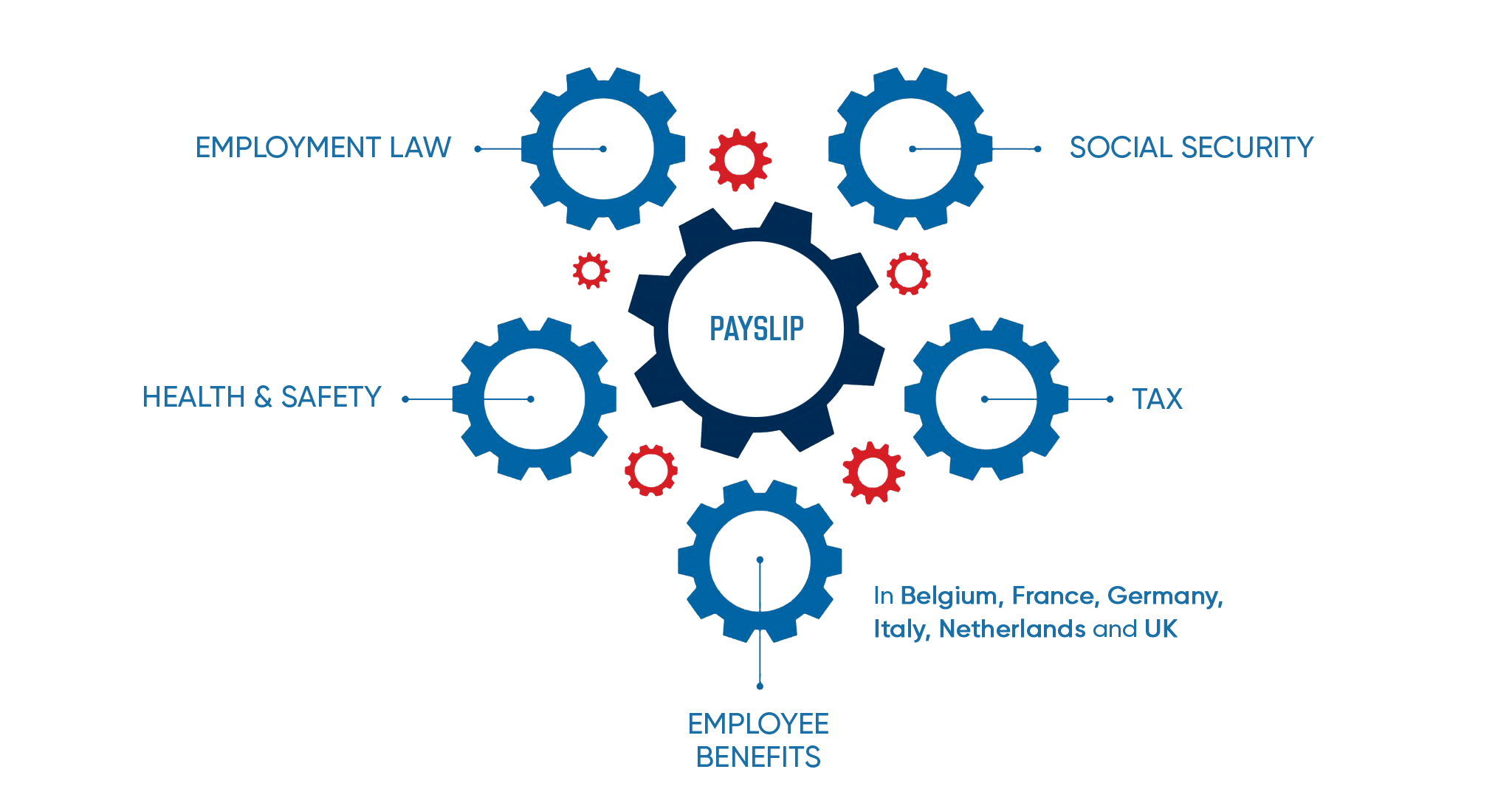

Interfisc 5 Pillar Model

Thanks to our “5 pillar-model” we ensure that your international payroll runs smoothly.

Creating a payslip seems easy, but involves quite a lot in practice. Especially in the case of cross-border employment. Based on our many years of experience and expertise, we have developed a “5 pillar-model” to make this clear.

Our 5 pillar-model shows how employment law, social security, taxes, employee benefits and health & safety in combination with each other impact the creation of a payslip. As we include all these pillars in our services, in several countries, this will result in a correct payslip and personnel management.

Keep up to date on the latest news!

Sign up for our newsletter and receive the latest information on employer obligations in the Netherlands, Belgium, Germany, France, Italy and the United Kingdom.

Together, solution-oriented and caring

Since 1972, Interfisc has offered international HR & Payroll solutions in the Netherlands, Belgium, Germany, France, the United Kingdom, and Italy. We do this from our offices in the Netherlands and Belgium, and with an international team of around 45 committed and caring employees.

- Thorough knowledge of local rules on employment law, social security, taxes, employee benefits and health & safety

- We keep you informed of changes in local legislation, supplemented with practical solutions

- One point of contact for all your questions

- Expert in cross border payroll solutions since 1972

- We speak your language!

Need to know more?

Questions about what needs to be done?

Our customer support team is at your service, you can reach us by phone or via the contact form.

Not found what you were looking for?

In the world of international employment, every situation is unique.

If our website does not provide the answers, please do not hesitate to contact us, together we can work out the best solution (to your needs).

More information

Subscribe to our newsletter!

Stay up to date on employer obligations in the Netherlands, Belgium, Germany, France, the United Kingdom and Italy.

- Copyright Interfisc 2024